Astra, Knot, and Pinwheel: 3 must-have tools for seamless customer account openings

Find out how Astra, Pinwheel, and Knot can help banks streamline the account opening process, increase account usage, and boost customer loyalty.

Takeaways:

- Astra, Pinwheel, and Knot streamline the new bank account opening process, increasing usage and customer loyalty.

- Astra enables instant account funding via debit card, Pinwheel simplifies direct deposit switching, and Knot streamlines updating payment details across online accounts.

- Banks that use Astra, Pinwheel, and Knot can differentiate their business with a frictionless onboarding experience.

Consumers have 5.3 different bank accounts on average, but still consider just one deposit account to be their “primary account.” What goes into making that decision? Surveys show that customers pick a main bank for a variety of reasons, but the most influential may be comfort.

This revelation may cause banking leaders to wonder, “What can I do to make my customers more comfortable?” With so much competition for a customer’s time and funds, financial institutions need to lean into those first few moments after account opening — when the debit card is freshly activated, and there’s still excitement around the promises of the new partnership.

Without an emphasis on this honeymoon period, customers could set aside their new debit card and forget about it entirely. They’ll likely go back to their original accounts out of familiarity or because it’s just too complicated to learn how to engage with the new bank.

Three tech companies have created their own unique solutions to help foster account loyalty. Astra, Pinwheel and Knot enable banks to make account onboarding seamless for the customer.

Fund with Astra

Every moment customers have to wait to start using your card gives them time to reconsider the relationship. After all, there are dozens of competing card companies and neobanks ready to step up and take your place.

Astra enables customers to fund their new accounts instantly using the Visa Direct network’s Card-to-Card transfer technology. There’s no need to wait days for a mobile check deposit, and ACH from another account, or a deposit via an ATM. Customers can enter the information from their other debit card and access funds right away.

This instant funding option increases the odds that the card will go straight into the customer’s wallet and become part of their day-to-day spending habits. It also increases the average initial deposit, improving the likelihood that the customer will stick with the debit card account for the long term.

Without such a seamless and instant funding option, customers may not see the new account as convenient or practical to use. Astra’s instant funding overcomes these challenges and satisfies the customer’s need for a banking option that moves in real time.

Switch direct deposits with Pinwheel

Customers may abandon your bank if they run out of money in their accounts. The easy fix is to have them set up direct deposit. Many institutions reward this behavior by waiving fees or offering bonuses with a recurring direct deposit arrangement, such as weekly paychecks.

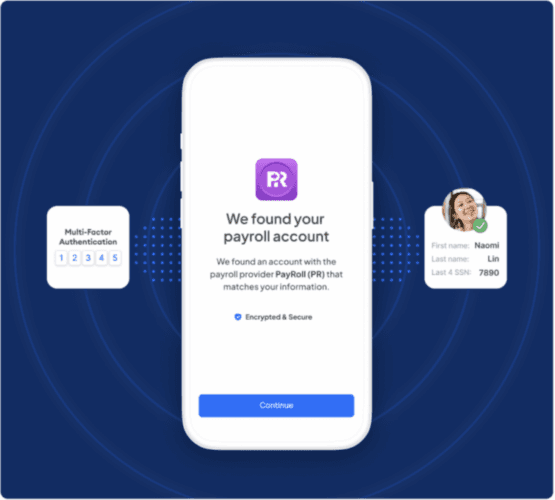

However, switching a payroll direct deposit is traditionally very cumbersome for consumers. They typically must go to HR and fill out paperwork before waiting weeks to see the change process. This administrative work, plus the inconvenience of not quite knowing when the new deposit will take effect, is beyond what most customers want to deal with.

This point is critical for banks trying to encourage new account openings. In recent research, 73% of consumers said they are considering switching banks within the next 12 months, but the majority also reported that easy direct deposits are highly important in the account opening process.

Pinwheel cuts through all these objections with a user-friendly technology that switches direct deposits upon account opening and onboarding. Customers can search for their employer or payroll administrator and confirm the switch via a convenient mobile process. The I-9 matching requires no additional verification and reduces fraud.

Once the customer sees how easy it is to switch their direct deposit, they will be more likely to use your bank over others. In user testing, Pinwheel found that 72% of consumers say they would be more likely to make a bank their primary bank if it offered its Prime solution at acquisition.

The first big trial for a new bank’s digital experience is the account opening. Banks can’t effectively compete for primacy without a seamless deposit switch as part of that journey.

Update payment methods in online merchant accounts with Knot

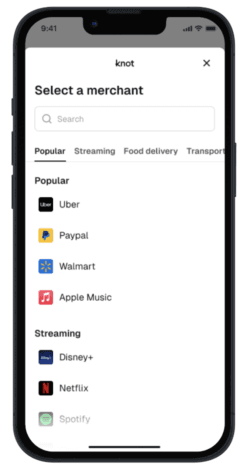

Shortly after receiving a physical or virtual card for their new account, customers have to update their ecommerce and bill-pay profiles with the new payment information. The process of updating payment methods at many different online accounts is tedious, especially if there are a large number of accounts that need updating.

So, how can you ease that burden? With Knot.

Knot’s CardSwitcher technology, which integrates into the new account onboarding process, makes swapping out cards much easier. It’s the only live API-based card-switching product on the market, while some of Knot’s competitors use humans to switch cards manually.

To understand Knot’s benefits, imagine a customer opens your banking app and is prompted to add their new debit card to their existing e-commerce accounts.

They can search for and select an online account and then once logged in, automatically add the new card details at the top of the wallet. Knot’s technology keeps them from having to manually enter their new card information on every website and is much more mobile-friendly than the standard way of updating debit cards. Everything happens from within a single app environment.

It’s also a win for the businesses the customer frequents, like their grocery delivery service or streaming account. There’s no interruption in service while waiting for the new card information to be entered; no time is wasted on trying to charge an old or outdated card.

By making it easy to designate new cards as preferred payment methods, Knot encourages your customers to stick with your accounts. The platform services over 100 of the top online merchants and has supported over 100K successful card switches. Beyond account openings, Knot helps you retain these users when their card expires, as it simplifies the process of updating outdated payment information.

Opening an account: Before and after

The old way of onboarding a new customer might look like this:

- The customer opens a new checking account and receives a debit card in the mail ten days later.

- They must have money in their account to use it right away, which may not happen until their next payday.

- Another two weeks pass as they wait for their direct deposit to take effect, and their bills are in limbo. They can’t use their old debit card account because they want to shut it down, but there’s not enough time to get the new account funded before the next bill payments are due.

The average customer has to do this with dozens of businesses, all with different payment dates — including very important transactions, like those for rent, food, utilities or gas to get to work.

Now, imagine you have an onboarding process with the three solutions we talked about: Astra, Pinwheel and Knot.

- The customer opens a new account online and is given a digital debit card within minutes. Thanks to Astra, they can use the balance of their old debit card account to fund their new card instantly, and they can use the new digital card right away as part of their digital wallet.

- They get prompted to update their favorite online shopping accounts with the new debit card using Knot, including their favorite coffee shop, grocery delivery service and cell phone provider. It’s all done through the banking app.

- After they are done, they can use Pinwheel to designate their paycheck to be deposited directly to the same account. By the next pay period, the money arrives in their account, and they can immediately spend it with their debit card.

Because their shopping accounts are already updated, there are no extra steps to take to spend their paycheck on the things they need for themselves or their loved ones.

Differentiate your bank with Astra + Pinwheel + Knot

With Astra, Pinwheel and Knot, the account opening process can be rewarding. Best of all, customers don’t get this level of service in the wider market. Banks that simplify account openings first will earn a reputation for offering a frictionless customer experience.