The Functionality Your Customers Want, The Revenue You Also Want

Real-time payment solutions are the expectation for today’s apps, but they need not be expensive for your business.

Every day in the US, hundreds of billions of dollars move. They move from investment accounts to checking accounts, person to person, person to vendor – millions of transactions all quickly sending funds from place to place.

The speed at which those funds move, much like airplanes designed in the same 1960s-1970s era, seem to have hit a speed cap that only recently is shifting. Partly due to COVID, touchless transactions largely replaced cash-based ones, and the pressure to have funds arrive near-instantly is the new expectation. And yet, most money is still quite slow.

In 2022, NACHA processed $77 TRILLION in ACH volume across 30 billion transactions. By contrast, The Clearing House networks RTP solution, as of June 2023, has only completed 500 million transactions – ever.

Although the need for faster payments is here, and the value proposition is clear, the adoption rate for both businesses and consumers has been slow. Part of this is the classic “if it ain’t broke” problem, but the other is that these new payment methods can expand your risk exposure and increase your costs.

But they don’t have to be.

Enter Astra’s real-time payment solutions, delivered by API and powered by Visa Direct. As a full-stack payment solution, you can start your integration purely online and go live with an integration that gives you access to ACH, RTP, and Visa Direct in as little as 30 days from start to finish. But what makes the deal even sweeter is that most Astra integrations are cashflow positive.

Add payments, get paid.

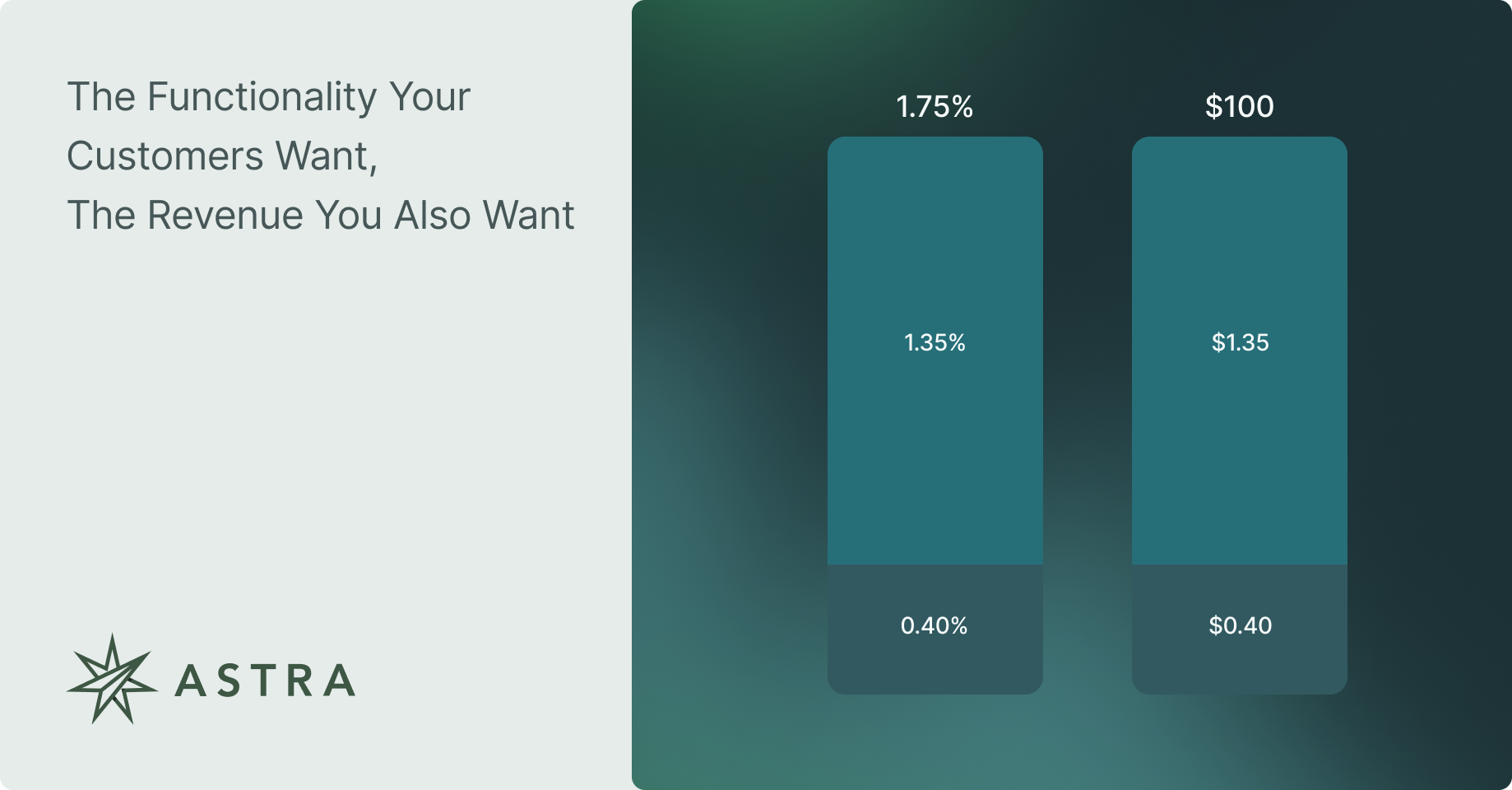

Because we operate with a transparent pricing model where we apply a flat rate to each transfer, as the product owner, you are able to additionally add a small rate to the cost of that transfer for your users, covering your Astra costs and even generating new revenue streams for your product overall.

As an example, let’s say you have a Vertical SaaS company serving car repair shops. You provide software and payments solutions for small businesses like Jane’s Engine Repairs, LLC who processed card transactions and employee wages with you. Right now for payouts for merchant sales and payroll, you are likely using an out-of-the-box ACH solution, which is probably quite inexpensive, but slow to settle. Your capital and your customers earnings are tied up in the every business day clearing of traditional payment rails instead of spending more time in your and their operational accounts. Jane and her team do work 24/7/365, but their payments don’t. If it’s Friday at 6p, she might prefer or need an option to receive merchant sales to repair equipment or pay her employees right now through an instant disbursement.

Through an Astra integration, everything changes:

- Flexibly offer traditional clearing via both ACH and real-time payments to grow and retain your customer base

- Massively reduce capital and operational overhead through Account to Card payments

- Collect programmatic fees per instant transfer to cover costs and generate revenue

After four weeks of development time, you can now offer all of your customers the ability to send funds near-instant in a variety of configurations – account to account, account to card, card to account. That onboarding process of your customer is now best-in-class – they operate their business, generating sales and revenue, and with a few taps in your application, they can transfer funds to their business.

Fast integrations, instant money movement, best-in-class customer experiences – contact Astra to see how we can help change your customers’ payment experience and your financial outlook.