Why Astra Saves You Time, Effort, and Engineering Resources

When a company builds payments infrastructure, the default instinct is to assemble a stack of point solutions: a bank partner, a payments processor, an identity verification provider, a customer onboarding tool, a bank connectivity service, a chargeback manager, and a transaction monitoring platform. Each of those vendors has its merits—but taken together, they create a heavy implementation burden for your team.

With Astra, you skip that mess.

The Problem With the “Stitch-It-Together” Approach

If you aim to build your own payments solution from the ground up, you are going to need several different providers – the required list would include:

Bank Partner — needed for regulatory coverage, accounts, and sponsorship.

Payments Processor — to actually move funds.

Identity Verification Provider — for compliance checks and fraud signals.

Customer Onboarding Tool — for layered risk and KYC workflows.

Bank Connectivity Service — for linking customer accounts and balances.

Chargeback Manager — to handle disputes and reversals.

Transaction Monitoring Platform — to watch activity for fraud and AML issues.

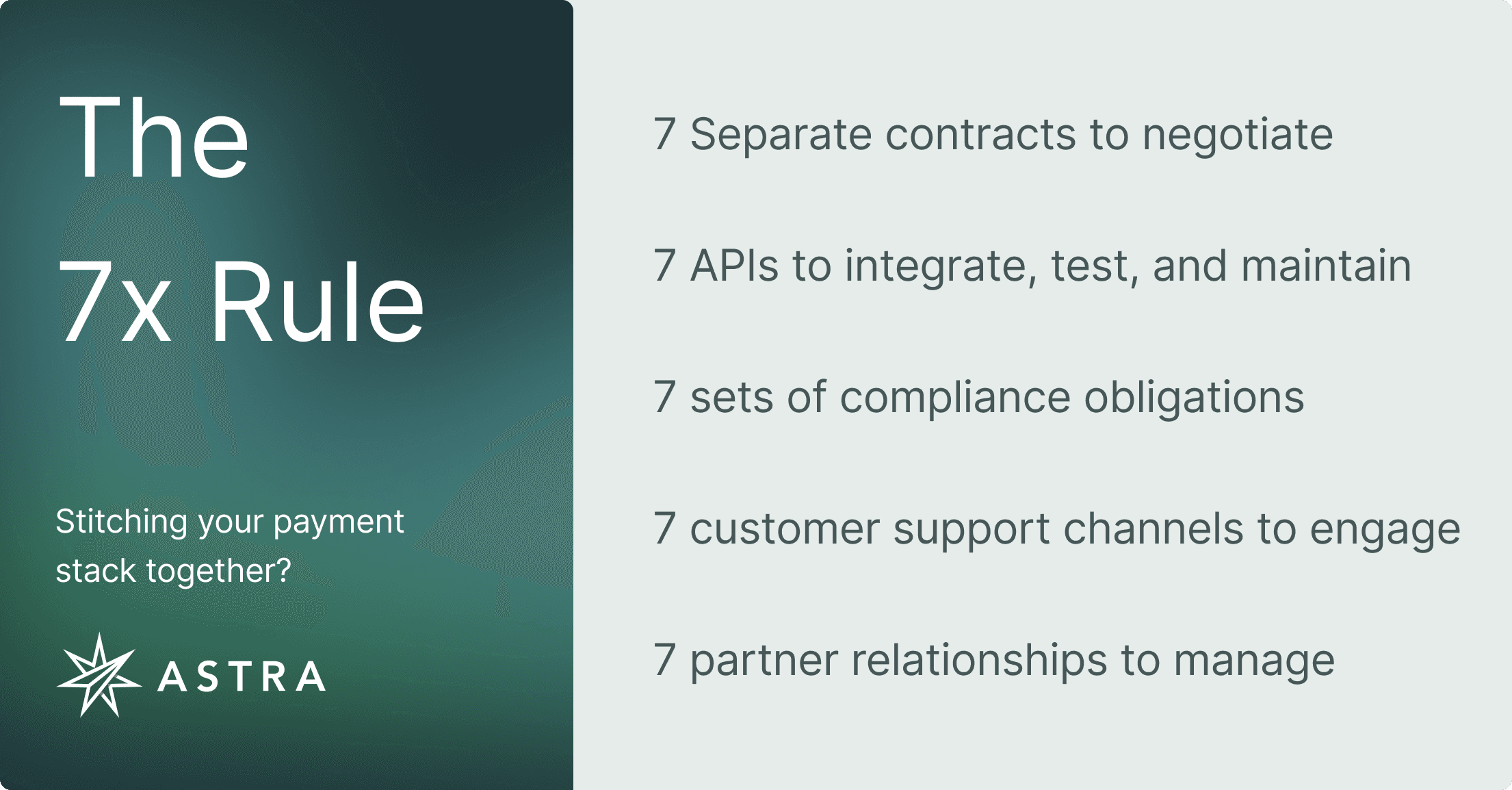

That means:

- 7 separate contracts to negotiate

- 7 APIs and legal frameworks to integrate, test, and maintain

- 7 sets of compliance obligations

- 7 customer support relationships

- And—most importantly—7x the engineering lift just to get started.

Having that many vendors is complicated enough, but what is even more complex is determining how all of them will work together.

What Astra Gives You Instead

Astra bundles the essentials into one API-driven platform:

Bank Partnership — immediate access to the banking rails you need, without a 6–12 month search for the right bank partner and negotiation.

Money Movement — instant transfers, push/pull ACH, and card rails.

Identity & Compliance — built-in KYC/AML orchestration with flexible workflows.

Bank Connectivity — account verification and balance checks without extra integrations.

Risk & Chargebacks — fraud detection and dispute handling built directly into the workflow.

Instead of spending months (or a year) connecting disparate systems, your team can launch in weeks!

Save Engineering Hours Where It Counts

| Vendor Function | Typical Integration / Setup Time | Ongoing Maintenance | With Astra |

| Bank Partner | 6–12 months | High | ✅ Included |

| Payments Processor | 6-12 weeks | High | ✅ Included |

| Identity Verification | 2–4 weeks | Medium | ✅ Included |

| Customer Onboarding | 2–4 weeks | Medium | ✅ Included |

| Bank Connectivity | 3–4 weeks | Medium | ✅ Included |

| Chargeback Management | 2–3 weeks | Medium | ✅ Included |

| Transaction Monitoring | 4–6 weeks | High | ✅ Included |

| Total | ~12 months+ | Ongoing complexity | 2–3 weeks to go-live |

By consolidating, Astra helps you:

- Save months (or years) of development and vendor onboarding time

- Reduce vendor management overhead

- Lower total compliance exposure

- Accelerate go-to-market

The Real Opportunity

You want the opportunity to win through your payments offering, not become a payments company. Building a full payments stack shouldn’t be a project that drains half your roadmap. By choosing Astra, you remove integration complexity, shorten launch timelines, and free your engineers to build product features—not payment plumbing.

That’s the Astra advantage: skip the stack, launch faster.