A payment gateway won’t cut it for platform growth. Here’s why

Key takeaways

- Integrating an instant payment solution into your platform seems simple at first. But facilitating payments is much more than integrating a gateway.

- You must establish bank relationships, figure out compliance, solve infrastructure gaps, manage operational overhead, and maintain minimum reserves.

- Payment gateways also limit your ability to protect merchants from fraud, deliver poor customer experiences, and limit flexibility.

- A full-stack payments solution solves these issues and helps you differentiate your product.

Building a successful software platform is a lot like solving a jigsaw puzzle—you’re always calculating how each piece fits into the bigger picture. Now, imagine thinking you know how one piece fits, only to discover it doesn’t and that you need even more pieces to complete the full puzzle.

Turns out, you underestimated how difficult it is to fit that piece into your puzzle.

This situation illustrates what SaaS and vertical software providers experience when integrating payment gateways into their stack. You need a Merchant of Record. You have to maintain reserves. You need bank sponsorship. You have to figure out PCI compliance.

Your payment gateway has now morphed from a piece of the puzzle to a full-blown growth bottleneck.

Here’s why you should think twice before choosing a payment gateway as your payment facilitation channel:

- Payment gateway implementation may not be worth the squeeze.

- Payment gateways are reactive—not proactive—to fraud.

- Payment gateways limit your merchants’ business models.

- Payment gateways deliver substandard customer experiences.

Let’s look at these in more detail.

Payment gateway implementation may not be worth the squeeze

On the surface, integrating a payment gateway seems simple—you ping an API to create a transaction, and you’ve facilitated payments for your customers.

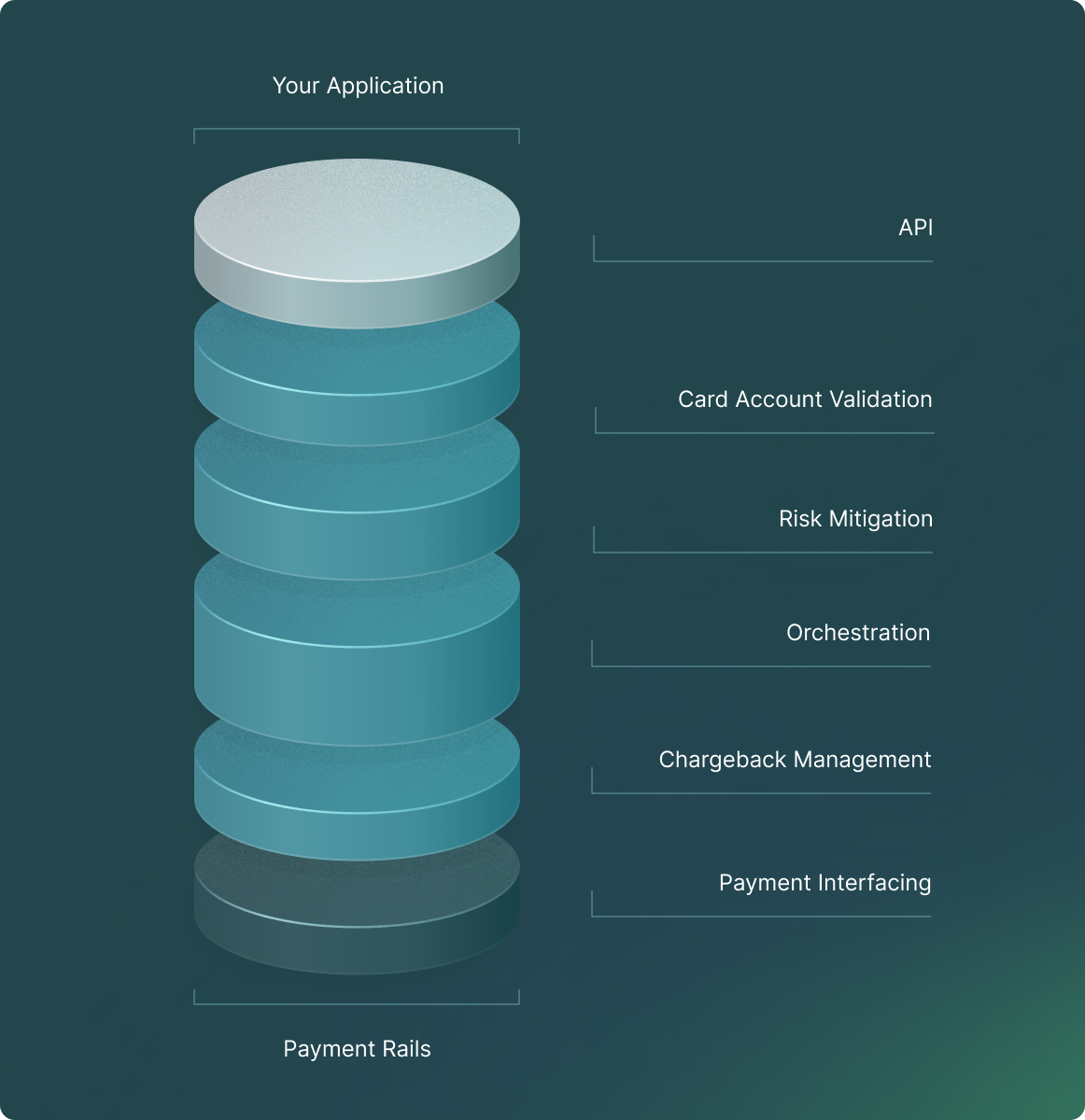

But payments is a complex world and a highly regulated one. A payment gateway is just one piece of infrastructure you’ll need to successfully facilitate payments.

Here is a list of processes and infrastructure you’ll need to begin using your payment gateway:

- Set up a Merchant of Record.

- Establish an acquiring bank relationship.

- Set up a For-Benefit-Of (FBO) account.

- Create reconciliation workflows.

- Install payment orchestration infrastructure.

- Design a payments dashboard to deliver payment data to merchants.

- Install and monitor security controls.

These processes may seem small on paper but involve several additional workflows.

For instance, establishing a bank relationship is a lengthy and costly process. Installing orchestration infrastructure is a time-consuming project—one that needs dedicated resources and time to manage.

As a result, your expenses and infrastructure maintenance increase significantly, while your payment gateway doesn’t bring much revenue to offset these headaches.

Worse, all of these additional requirements take your attention away from growing your platform. A full-stack payment solutions provider solves these issues with an out-of-the-box solution customized for your business.

Payment gateways are reactive—not proactive—to fraud

Payment gateways bolt quickly onto your platform but leave the most important task to you—mitigating fraud. A gateway acts more like a plugin to your platform, not a business partner.

It facilitates the payment and gives you an accept or reject message. It does not help your merchants deal with chargeback requests or fraudulent transactions.

If your merchants are experiencing a wave of chargeback requests, a payment gateway cannot give you granular data to mine for patterns. Your merchants have no insight into why these charges occur or what they can do to mitigate fraud risk.

Worse, they’ll look at you as a less-than-adequate payment facilitation partner. The frustrating point is that you have no control over the payment gateway’s policies or controls.

The fraud issue gets worse if you serve high-risk industry merchants like gambling or cryptocurrencies. Even if you find a payment gateway willing to work with you, you will place your merchants in a reactive, not proactive, mode when handling fraud.

Writing for the Fair Isaac Corporation (FICO) blog, TJ Horan, product vice president of product management, says the demand for real-time payments is stressing existing fraud controls and that establishing behavioral baselines is critical.

“The root solution to defending customers and all their payment channels comes back to the same concepts,” he says. “Knowing what normal looks like, acting when something happens that isn’t normal, and communicating as much as possible through sensible friction and personalized notifications and alerts.”

A full-stack payment provider puts fraud mitigation controls in your hands. Here are some of the fraud mitigation solutions you can offer your merchants:

- Payment status dashboards

- PCI compliance

- KYC dashboards

- Customer IP and geography details

- Chargeback management

- Automated fraud detection engines

Help your merchants log user activity, monitor payment patterns, analyze user intent, and protect users from fraud proactively.

Payment gateways limit your merchants’ business models

Despite their limitations, payment gateways make sense for stable businesses that do not change their business models too much. However, if your merchants regularly offer new products or experiment with different pricing strategies, your payment gateway could limit their growth.

For example, the gateway might tag a new product as high-risk or flag new transaction patterns as fraudulent.

Your merchants view you as their payment facilitator, leading to a sticky situation where you understand their goals but cannot orchestrate a payment solution to fit their needs.

Payment gateways force you to offer a one-size-fits-all solution that works well right up to the moment when it fails and your merchants realize the limitations you’re placing on them.

In contrast, a full-stack payments solutions provider puts infrastructure in your control. Customize it to your merchant’s needs, give them the ability to respond to market changes quickly, and help them grow their businesses.

Best of all, full-stack payments give you the functionality your customers want and the revenue you want.

For instance, our customer Fold has a unique business model that incentivizes purchases by rewarding customers with cryptocurrency. However, delivering this functionality with a payment gateway is challenging.

Fold would have to establish a settlement account to pre-fund and reconcile transfers. And that’s before considering integration timelines (more than six months) and costs.

With Astra’s full-stack solution, Fold avoided these headaches and focused on delivering the functionality its users wanted.

Payment gateways deliver substandard customer experiences

A Forrester Research study in 2022 estimated that a one-point increase in CX can drive a billion dollars in revenue for enterprises. Forrester also reported that improving CX is a top priority for executives in large companies, highlighting its impact on retention, loyalty, and growth.

Payment experiences play a crucial role in increasing user trust. But with a payment gateway, you’re effectively outsourcing this trust driver.

Customer experience (CX) is a growth driver, and a payment gateway will add nothing of value here. In fact, it might harm CX. A payment gateway works well until it breaks—and now you cannot address the problem quickly.

While downtimes are not your fault, they damage your merchants’ opinion of your platform, much like the brand damage Zelle experienced when JP Morgan’s infrastructure caused downtime and a wave of customer complaints.

Zelle’s customers didn’t care that JP Morgan’s infrastructure was to blame—they were more concerned about Zelle not accurately displaying balances and how the app was not responding.

You also cannot do anything to improve CX, such as offering features like instant payments or bank transfers to your merchants, if your payment gateway does not support them.

In short, you get all of the downsides and a few upsides. A full-stack payment solution flips this equation around:

- You control your infrastructure with the help of a trusted partner.

- You can respond quickly to merchant needs, even helping them brand their payment channels.

- Offer access to payment analytics. Help your merchants dive into declined payment causes and offer data to address any process gaps.

Our customer Moves—the banking app built for gig workers—is a great example of the impact instant payments has on CX and growth.

Since integrating with Astra, Moves has witnessed a 4.5x increase in instant transfer activity accompanied by a 2x+ increase in deposits in the first three months.

With gig workers now able to instantly withdraw their earnings, Moves offers its customers a memorable and highly differentiated product.

Your payment gateway is too big a puzzle to solve

Payment gateways may be a quick way to offer payments, but they bring plenty of baggage. From establishing bank relationships to figuring out compliance, payment gateways hinder your growth.

Curious to discover how Astra’s full-stack payments solution can help you unlock growth? Get started with our sandbox today.